Monetization is how YouTube wins, and YouTube knows it!

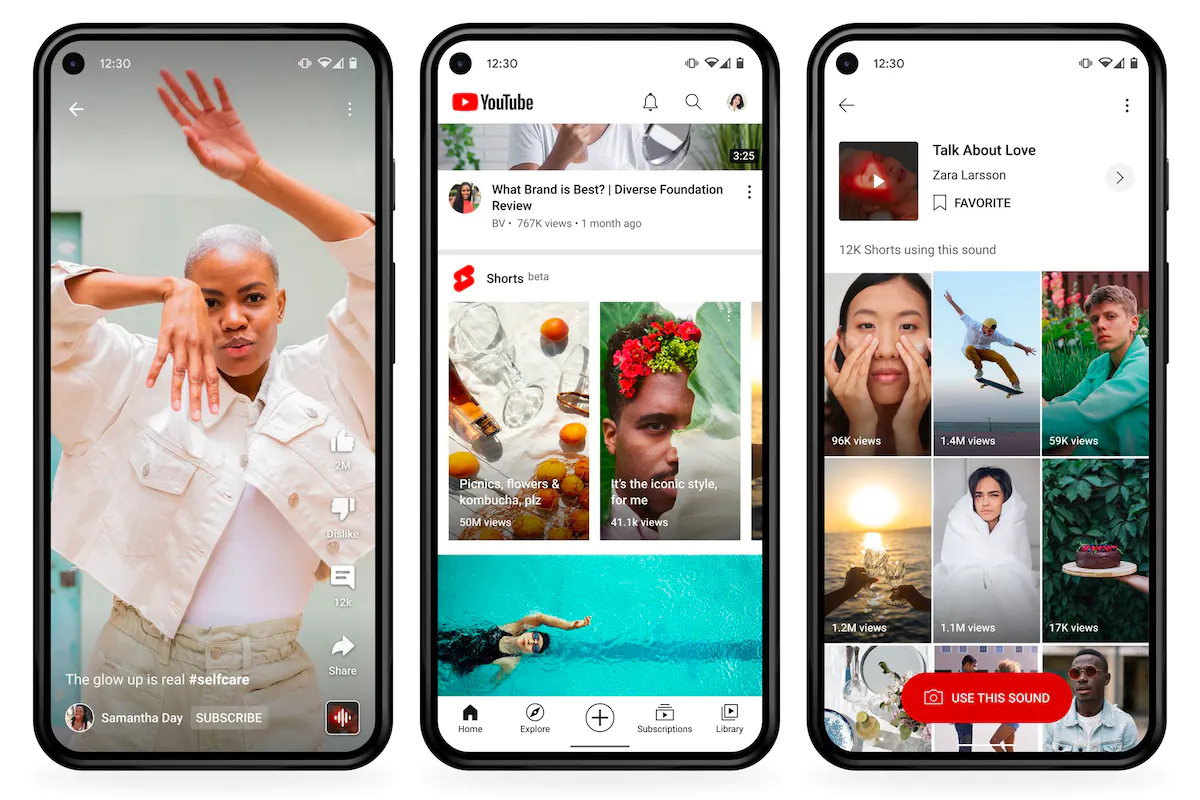

In its ongoing battle with TikTok for vertical video supremacy, YouTube is about to play its most valuable card. It’s getting ready to turn on aggressive monetization for Shorts, its short-form vertical video format, and promising to help millions of creators make money on the platform.

Starting early next year, Shorts will be part of the YouTube Partner Program, meaning those who qualify can start getting a share of the ad money generated in Shorts. YouTube is also making it easier for creators who don’t qualify for the program to make money through tips, subscriptions, and merch sales. (The New York Times first reported the news.) The goal is to offer more and better monetization options than TikTok and potentially win over (and win back) many of the creators flocking to the rival platform.

The announcement comes about 18 months after the original launch of Shorts and a year after YouTube’s chief product officer Neal Mohan promised a “long-term monetization project.” Shorts appears to be growing fast: Amjad Hanif, YouTube’s vice president of creator products, says the feature is seeing 30 billion views a day and 1.5 billion people are viewing them every month. Shorts can often still feel like a TikTok clone, though, and it certainly hasn’t hit TikTok’s level of cultural cachet. But what TikTok drives in culture, YouTube drives in revenue.

Until now, YouTube has monetized Shorts in small ways, through creator funds, shopping, and tips. Those are similar to the ways TikTok and Instagram monetize their own vertical video, and many creators feel they’re not enough. Hank Green summed creator funds up pretty well to The Verge’s Nilay Patel on the Decoder podcast: “I hate them.” What Green and others want is the standard YouTube model in which YouTube keeps 45 percent of all revenue generated by creators’ videos and creators get 55 percent. That revenue share has turned YouTube into a career for lots of creators, and while YouTubers have their issues with the platform, that split has tended to work. “The moment YouTube launches its monetization product for Shorts has to be soon,” Green said.

Shorts isn’t quite getting the full YouTube deal, though. The platform is flipping its percentages, keeping 45 percent of revenue for itself and giving 55 percent to creators. Hanif explains that part of that extra money will go to paying for the music used on the platform so that creators can use anything in the library without worrying about rights. Either way, YouTube thinks it’s a better deal than creators are getting just about anywhere else.

YouTube’s also trying to make it easier for creators to monetize on the platform, especially those who haven’t yet hit the bar — 1,000 subscribers, and either 10 million Shorts views in the last 90 days or 4,000 longform watch hours overall — to get into its Partner Program. The company is introducing a new tier through which creators can get to features like the Super Thanks tipping option and paid channel memberships without being part of the ad program. Hanif won’t say the exact requirements for that tier except that it would be much lower than the existing ones. “And so, a lot of creators earlier in their careers who have taken a little bit longer to join the program will be able to join much earlier,” he says, “and start getting a paycheck much sooner than they were in the past.”

With traditional YouTube videos — what Hanif calls “longform YouTube” — the ad model is fairly straightforward. Users click on a video, they watch an ad before or during the video, and creators get a chunk of the revenue from that ad view. There’s no question of who generated that ad view or who gets the money.

With a fast-moving feed of short-form vertical video à la Shorts or TikTok, it’s vastly more complicated. If you watch one whole video, then flip through three more, then see an ad, then watch two more full videos, then close the app, who gets paid? What if one of those videos is a duet or a remix of another video? What if they’re all challenges set to the same song?

Many of those details aren’t yet figured out, which is why the Shorts Partner Program isn’t launching until next year. But Hanif describes the rough plan this way: if you open Shorts, watch six videos, see two ads, and leave the app, YouTube will take the ad revenue from those two ads and split them among the six videos.

“Probably the biggest difference you’ll see from other products in our longform,” Hanif continues, “is sometimes watch time played a big role.” That’s one reason you’ve started to see YouTube videos getting longer over time. “But in the case of short format, where you’re talking under 60 seconds, it’s a really a view that is the criterion that matters.”

But that brings up another question: what’s a view? YouTube doesn’t like to define the word publicly, and Hanif would say only that “it’s a few seconds — we don’t count it right when it shows up.” Advertisers want to know what users actually watch, he says, and so do creators.

What this all means, in practice, is that Shorts will likely be less lucrative to the most popular channels, who will now have to share revenue with everything else in the feed but will allow more people to make money. That seems to be exactly YouTube’s goal: Hanif says YouTube has about 2 million monetizing creators right now, and he expects that number to be closer to 3 million by the end of 2023. One way TikTok has succeeded is by relentlessly promoting new creators to its audience, and YouTube seems to want to do the same.

YouTube says it has paid creators more than $50 billion over the last three years. Building Shorts into a meaningful part of that will take time. “Our ad sales team has been working with lots of advertisers on it,” Hanif says, “and it will take a while to build it up to the business we’ve had in longform.” YouTube’s also still sorting out how, exactly, to talk to creators about making use of all the tools — longform, live, Shorts, and everything else — on the platform.

But he keeps returning to the same point: “It’s really the first platform at scale that is going to share revenue with short-form creators where they can actually expect a paycheck and earn money.” There are lots of details left to deal with, but YouTube’s betting that paycheck will be enough to keep people around while it figures them out.

source: The Verge.